|

|

|

|

Welcome back, #RichGirls and Boys. Some weeks, we discuss the theoretical—we ask ourselves, “What does it all mean?!” as we try to stay the course during #VolatileTimes.

Other weeks, we dive headfirst into the technical weeds. This is one of the latter weeks.

While the heady stuff is (candidly) fun for me, it usually ends up inviting a barrage of DMs that range hilariously from the innocuous (“Money isn’t happiness, you dreadful capitalist!”) to the political (“You’re a raging socialist!”).

Weeks like these—when we’re talking tax optimization, account types, and deal structures—feel like a respite.

Without further ado:

-

A blog post that discusses the two most optimal ~account mixes~ for those with W-2 wages and 1099 income (i.e., the 56% of millennials who have side hustles, this is for you).

- A podcast episode about buying cash-flowing assets (like commercial real estate and small businesses) after the height of business closures during the global panini.

-

A throwback blog post about how to use your pre-tax accounts—like your 401(k)—in early retirement without paying the 10% penalty (plus, how to get it all out tax-free, if you’re ready to waltz through a few more steps)

—Katie Gatti Tassin

|

|

|

I had an important realization the other day that I feel I must share:

Most full-timers with side hustles (hello, millennials) aren’t taking advantage of the amazing tax benefits available to them.

Why does this matter, you ask?

“Katie, your fancy alphabet soup accounts do not interest me. I have a Robinhood account and I’m not afraid to use it.”

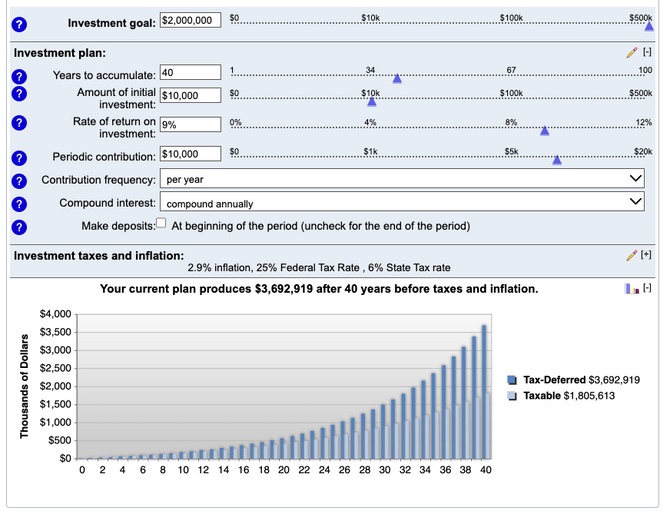

But don’t you want tax benefits?! Let’s quantify just how much money we’re talking about here. Assuming you’re investing $10,000/year for 40 years (illustrative purposes only) and get a 9% average rate of return before inflation, the difference between investing in tax-deferred/tax-sheltered accounts or outside tax-deferred/tax-sheltered accounts is *clears throat* $1.8m and $3.7m.

It doesn’t look like much in the first few years, but tax drag is not your friend. If having an extra $2m in 40 years is interesting to you, it’s worth it to minimize tax drag wherever possible. Take a look:

Assumes 2.9% inflation, a 25% federal tax rate, and a 6% state tax. Assuming inflation is consistently higher over time (let’s say, 8%), the difference is nominally the same, but your purchasing power is lessened for both amounts.

Today, we’re going to break down the two most optimal account mixes for people who have both W-2 income and self-employment income from a side hustle (commonly referred to as 1099 income going forward, because I’m fancy like that, and so are you).

Got it?

W-2 = wages from beneficent Corporate Overlord from which taxes are already deducted

1099 = income from side gigs from which taxes are not already deducted

Having both types of income opens you to myriad possibilities with respect to fancy tax footwork—so let’s dig into the best two combinations.

Keep reading.

|

|

|

-

Selfish, Shallow, and Self-Absorbed by Meghan Daum. This book’s subtitle is “Sixteen Writers on the Decision Not to Have Kids,” and when it arrived, my husband had some…questions. While I plan to have kids eventually, I saw an excerpt from this book that dove into gender role theory, feminism, and the idea that a woman’s “natural” place in the home is really just an invented social convention that took hold after the Industrial Revolution. Friends, if you like essay-style writing, it is a phenomenal look into the “mother vs. career person” false dichotomy.

-

“Snap Back to Reality” by Jack Raines. The line goes up…until it doesn’t. The market for NFTs, meme stocks, and random cryptocurrencies plummets when gas costs $6 per gallon and you’re worried about putting food on the table: “The problem is, most players don't realize it’s a game. They think it’s investing.” Yes, it’s a sobering reality check, but don’t worry, that’s why we’re here, no? To help keep your investing feet on the ground!

|

|

|

This might be one of the single most useful things in my entire back catalog. Enjoy.

When I first learned about early retirement, I was blown away—so much that I didn’t really ask any questions about what happened AFTER you retired at 35 or 40 years old.

All I knew was I needed to save as aggressively as possible, as early as possible.

But then I started to envision the actual logistics of early retirement and withdrawing money from these accounts that are designed to be used after age 59.5, and I wasn’t sure what it would entail. And I realize this is a long way away for most of us, but I think it’s good to start taking these logistics into consideration now, so you have an idea of how you’re going to plan for early retirement. For some of us, it might be less than 20 years away—and planning your #ExitStrategy will help you confirm that you’re setting up your accounts correctly for later.

More importantly, it might encourage you to keep aggressively contributing to your Traditional 401(k), because you’ll see that you can use this money kinda-sorta-whenever thanks to a tax loophole! Might as well maximize your tax-advantaged account to avoid the annual taxes that eat into your returns in other taxable investing accounts, right? Right.

Roth IRA Conversion Ladder

Enter the Roth IRA conversion ladder: It’s the magic tax loophole that enables you to use your Traditional 401(k) before age 59.5 without the 10% penalty that normally applies.

If you’ve got a Traditional 401(k) and you’re thinking about retiring before your hair turns gray, here’s what you’ll do (it’s actually pretty simple!):

-

Convert your Traditional 401(k) to a Traditional IRA. This is a standard financial move in retirement (or whenever you leave a company). Your 401(k) provider can help if you’re confused, or you can use a service like Capitalize to roll over old 401(k)s into IRAs.

-

Perform a Roth IRA conversion with a strategically predetermined chunk of the Traditional IRA (more on this in a moment). This is also pretty common, but there are tax implications. That’s why you want to wait to do this until you’re retired and your income is low (or nonexistent), because the amount you convert from Traditional to Roth will be taxed in your current “income bracket.” If your only “income” is coming from your own accounts, it’s likely a lot lower than you think!

-

Wait 5 years (yeah, I know—kind of a bummer, but better than waiting 35 years, right?). After 5 years, you can use that converted money (the money you converted from a Traditional IRA to a Roth IRA) without the 10% penalty. *takes bow*

I have no idea why this bit of tax code exists or works, but as of this writing (December 2020), it does. (Note from May 2022: It still works.)

The reason it’s called a ladder is because you’ll do it every year: That way, after the first five years, you’ll have a chunk converted and ready to go every single year.

To find out how to pay no taxes on your Roth IRA conversion ladder, keep reading.

|

|

|

|

|

|

The Money With Katie Show

|

|

|

A couple months ago, I got really anxious about income.

Aside from ~lite paranoia~ being one of the core tenets of my personality, my concern was (probably) justified. Rumblings of a recession on the horizon, #stonks going down, and the fact that Money with Katie was my sole source of income started to make me feel a little…vulnerable.

So I started looking into alternative investments. While I had deeply considered and passed on real estate for the time being, I discovered an amazing world of online content around buying small businesses, and began my pursuit.

This episode dives into where I looked, what I found, the two businesses I almost bought, and why I didn’t pull the trigger. Plus, two interviews: with Sarah Becker, a friend of mine who bought a dilapidated commercial property in her neighborhood when she was 24, and Steffany Boldrini, a successful investor in the self-storage space.

Listen now.

|

|

Written by Katie Gatti

Was this email forwarded to you? Sign up

here.

|

ADVERTISE

//

CAREERS

//

SHOP

//

FAQ

Update your email preferences or unsubscribe

here..

View our privacy policy

here.

Copyright © 2022 Morning Brew. All rights reserved.

22 W 19th St, 4th Floor, New York, NY 10011

|

|

|