My brain doesn’t intuitively make sense of numbers—but when I see everything represented visually, it resonates. (Jump cut to me sitting on a bench outside my college calculus class on the phone with my dad, in tears.)

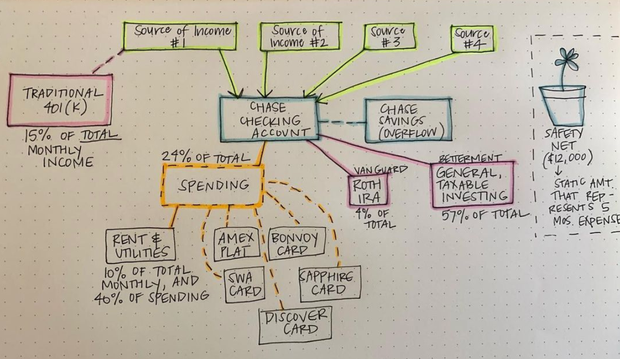

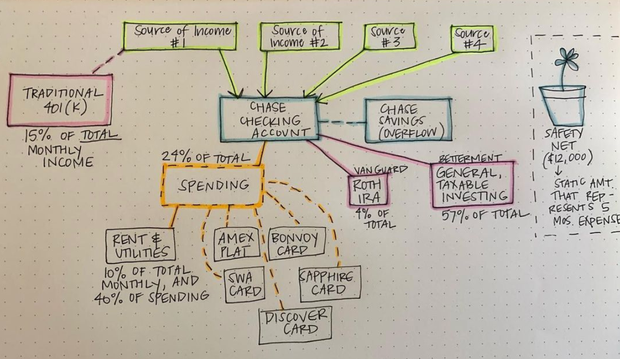

A few years ago, I did an exercise I lovingly called a “Money Map.” It looked like this:

My sincerest apologies for the inconsistent use of dashed and solid lines. I was excited.

The impetus was the realization that my financial life was becoming increasingly, unnecessarily complex. At the time, I had four (sometimes unpredictable) sources of income, a maximum 401(k) contribution, and a lack of a true “emergency fund” savings account, thanks to a taxable brokerage account product from Betterment called a “Safety Net” that I used instead.

Enter: My money mapping exercise. Out came the colored highlighters, and on came the lightbulb above my head.

If your financial situation is complicated to the point that it becomes hard to keep up with (like how mine was), it’s worthwhile to take the time to streamline the way your money flows through your financial system. Here’s how to make your own map, where the name of the game is simplification.

Income

Income

Sometimes we introduce more complexity slowly over time as our financial lives morph and grow around our habits. You know how it is: You start paying rent out of one specific checking account because it just so happens to be the one set up for withdrawals. Then, you open a new checking or savings account elsewhere, but still need to funnel money back to the old one to pay the rent, and, and, AND…it slowly becomes an unwieldy mess.

Of course, some people like to maintain a bunch of accounts for different things, but I’ve found personally that that becomes an unnecessary energy drain.

So, you’ll start by drawing the cash flowing from your income stream(s) into your central checking account (or accounts, if you maintain joint finances with someone in a “yours, mine, and ours” fashion).

The 401(k) contribution (or 403(b), or HSA, or…you get the picture) has to come directly from the paycheck, too, and that’s great—so make sure you’re demonstrating that on your money map somewhere.

🩹 Emergency fund

If you’re still growing your emergency fund, draw a line from checking to savings to represent your monthly flow of cash. If your emergency savings are already funded, set it off to the side to visualize its “reserve” status—like an account waiting in the wings.

If you have a habit of “over”-saving (and therefore “under”-investing), this mental separation can help you see where it might be more helpful to reroute extra funds to a more growth-y destination.

You may also have other savings or investing goals that you’re actively funding—like for a house down payment or future childcare—so you can draw those little metaphoric buckets as well.

Spending

Spending

Most of my spending—necessary and discretionary—happens on credit cards, which I pay for out of the checking account. There are a ton of reasons to use credit instead of debit cards: security against fraud risk, cash back, points…the list goes on.

But sometimes you have to pay something with a direct withdrawal (like my rent). I like to note that in my map where it makes sense.

While you shouldn’t find yourself in a position where you need to be actively transferring money into checking from savings to pay your credit cards, I like to know when there’s a big-ticket item that’s going to be taken directly out of checking instead of funneled through a credit card with a “delayed” due date.

Post-tax investments

Post-tax investments

When you open a post-tax investing account like a Roth IRA or a regular taxable account, you have to deposit money directly into those accounts from checking or savings. Remembering to do this on an ongoing basis as you earn every month can be tedious, so I like to set up bimonthly auto-transfers that happen in the days following when I get paid (though in recent years as my income has become increasingly variable, I tend to manually check at the end of every month and make manual transfers, too).

Taxes

Taxes

There’s a big missing piece of the visual puzzle above. Can you spot it? Taxes. Taxes will also be paid directly from your paychecks, so if you want to note it, you can. I recently sat down with a spreadsheet and listed our income, spending, and total tax burden, and was shocked at the pie chart that got spit out: We’ve paid more in taxes this year than we’ve spent on everything else combined.

That made me realize it probably makes sense to hire an accountant to double-check our tax strategy, vs. stressing about an incremental few hundred bucks spent here or there. (It also reminded me that now’s the time to invest in the business via #WRITEOFFS, if anything comes to mind.)

🫰 Why it works

Besides the fact that you can whip out the highlighters and touch real paper for the first time in months, money mapping helps you diagnose large trends in your financial life. (Bonus: If you draw things to scale, I bet the insights will become even more valuable.)

It can also help reveal gaps in your own understanding. If you start filling in numbers and realize that you don’t actually know where part of your income is going every month, it can help visually guide you toward possible solutions.

For example, when I saw that 57% of my investing was going into a taxable investing account, it made me wonder if there were other tax-advantaged options I could—*ahem*—take advantage of first besides my 401(k) and Roth IRA. (Spoiler alert: I ended up contributing more to my HSA and opening a Solo 401(k) for my self-employment income.)

Read the full blog post for my 2023 update.

Read the full blog post for my 2023 update.

![]() When adjusted for inflation, teacher salaries in the US are lower today than they were in the 1990s. Their wages reveal a disproportionately stagnating trend, and teachers who work full-time maintain part-time employment on the side at a rate nearly 4x the general population.

When adjusted for inflation, teacher salaries in the US are lower today than they were in the 1990s. Their wages reveal a disproportionately stagnating trend, and teachers who work full-time maintain part-time employment on the side at a rate nearly 4x the general population.![]() But “pay for performance” models in the US show mixed results. The relationship between higher pay and better outcomes isn’t clear, making the “higher pay” debate harder.

But “pay for performance” models in the US show mixed results. The relationship between higher pay and better outcomes isn’t clear, making the “higher pay” debate harder.![]() Low pay presents an issue for many educators, as at a high level, only one in two end up receiving any pension benefits at all—while only half of that group (so, one in four teachers) ends up receiving more than their original contributions (which means the average educator is more likely to lose money by contributing to their state pension than make any).

Low pay presents an issue for many educators, as at a high level, only one in two end up receiving any pension benefits at all—while only half of that group (so, one in four teachers) ends up receiving more than their original contributions (which means the average educator is more likely to lose money by contributing to their state pension than make any).![]() As the cherry on top of the world’s worst financial sundae, there’s a popular 403(b) scam targeting teachers (seriously—the SEC sued the since-rebranded company that peddled it, for $50 million), which means even their tax-advantaged accounts are likely to underperform.

As the cherry on top of the world’s worst financial sundae, there’s a popular 403(b) scam targeting teachers (seriously—the SEC sued the since-rebranded company that peddled it, for $50 million), which means even their tax-advantaged accounts are likely to underperform.![]() Listen to the episode to learn more—and hear from more than half a dozen #RichGirlNation educators who shared the inside scoop on their own experiences.

Listen to the episode to learn more—and hear from more than half a dozen #RichGirlNation educators who shared the inside scoop on their own experiences.